The Federal Reserve raised its benchmark interest rate half a percent.

The rate hike is the steepest increase in two decades and is an attempt to bring down inflation from a 40-year high.

On Wednesday, the central bank said it is increasing its benchmark short-term interest rate by 0.5%, marking the largest increase since 2000.

The Fed's goal is to bring down demand from consumers and businesses for goods and services. By boosting rates, it should become more expensive to borrow money to buy a home, car or other needs, prompting some people to hold off on purchases. A drop in demand could help tame inflation, which accelerated to 8.5% in March, the highest increase since 1981.

In theory, the rate hike should trickle down to the rest of the economy and compel businesses and consumers to cut spending.

Many economists argue that rate hikes won't address the supply chain issues currently pushing up prices, and that inflation is more likely to come down on its own in the coming year.

Inflation in most countries has soared to multi-year highs, driven by a rebound in economic activity and a further straining of supply chain disruptions in the wake of Russia's invasion of Ukraine, forcing many central banks to raise benchmark rates.

4/24/24 - Senate Passes Foreign Aid Bill

4/24/24 - Senate Passes Foreign Aid Bill

4/23/24 - Nursing Home Changes

4/23/24 - Nursing Home Changes

4/19/24 - UPDATE: Christian Music Artist Mandisa Has Passed Away - Tributes

4/19/24 - UPDATE: Christian Music Artist Mandisa Has Passed Away - Tributes

4/19/24 - Israel Carries Out Military Strike Against Iran

4/19/24 - Israel Carries Out Military Strike Against Iran

4/18/24 - Ford Issues Another Recall For Some Broncos

4/18/24 - Ford Issues Another Recall For Some Broncos

4/15/24 - Reaction After Iran Attacks Israel

4/15/24 - Reaction After Iran Attacks Israel

4/15/24 - TAX Day - File By Midnight

4/15/24 - TAX Day - File By Midnight

4/5/24 - Preparations for the Eclipse are Well Underway

4/5/24 - Preparations for the Eclipse are Well Underway

3/26/24 - A Major Bridge Collapse In Baltimore

3/26/24 - A Major Bridge Collapse In Baltimore

3/20/24 - FBI & IRS Warn Of Illegal Charities, Donation Scams

3/20/24 - FBI & IRS Warn Of Illegal Charities, Donation Scams

3/15/24 - James Crumbley Also Found Guilty

3/15/24 - James Crumbley Also Found Guilty

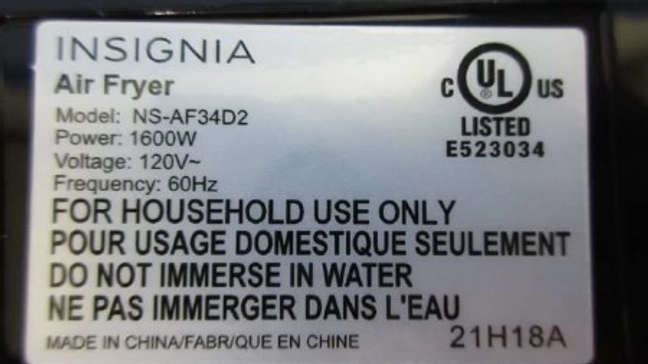

3/15/24 - Air Fryer Recall

3/15/24 - Air Fryer Recall