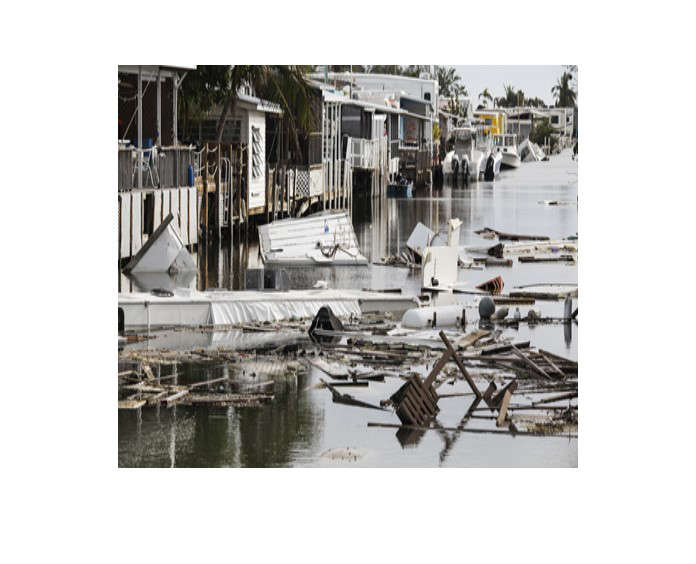

Damage estimates could reach close to 60 billion dollars, but the impacts could be even more devastating.

While damage estimates put costs somewhere between 42 and 58 billion dollars, the total costs from Hurricane Ian could be far worse. While the dollar amount is staggering, the losses themselves could dramatically affect insurance rates, companies, and homeowners in Florida.

Ian is believed to be the costliest storm since Hurricane Andrew in 1992. That storm cost over 27 billion dollars, equivalent to 53 billion in today’s money.

FEMA Director Dianna Criswell is quoted as saying there will need to be a long-term discussion on the impact the storm has had on the insurance industry. Industry experts are growing concerned for several companies, stating they may go bankrupt because of the losses. Both companies and claimants also face potential risks moving forward.

Insurance claims may take up to a year to close, due to the sheer amount of damage done in several states, as well as potential litigation as homeowners may not feel they are getting adequate settlements. Companies may also have to calculate the costs to themselves as they decide if they’ll continue to offer flood insurance in areas known to suffer hurricane damage.

Companies deciding to get out of the flood insurance market will leave homeowners with fewer options, thereby leading to increased costs for those products. It may also make it more difficult to qualify for insurance in a known flood plain. Homeowners will have to decide if they’ll accept the risks of going without flood insurance. The Insurance Information Institutes estimates 1 in 10 Florida homeowners are currently going without flood insurance. Some of those are by choice, others due to the high cost of premiums.

Those homeowners who forego the insurance, for whatever reason, will have to shoulder the costs of rebuilding as both state and federal help will be limited.

And homeowners have concerns that must be considered. FEMA’s direct grants to assist homeowners in a disaster will likely cover only 35-thousand dollars, a fraction of the total cost of most homes in the United States, and less than 10% of the price of most homes along the coast in flooded portions of Florida.

5/2/24 - It's The National Day Of Prayer

5/2/24 - It's The National Day Of Prayer

5/1/24 - Former President Trump Will Be In Michigan

5/1/24 - Former President Trump Will Be In Michigan

4/30/24 - Operation Ghost Rider Goes Into Effect In Michigan

4/30/24 - Operation Ghost Rider Goes Into Effect In Michigan

4/29/24 - Gov. Whitmer Signs Bills To Benefit Student Athletes

4/29/24 - Gov. Whitmer Signs Bills To Benefit Student Athletes

4/26/24 - Saturday is National Prescription Drug Take Back Day

4/26/24 - Saturday is National Prescription Drug Take Back Day

4/25/24 - Presidential Campaigning Heats Up In Michigan

4/25/24 - Presidential Campaigning Heats Up In Michigan

4/24/24 - Senate Passes Foreign Aid Bill

4/24/24 - Senate Passes Foreign Aid Bill

4/23/24 - Nursing Home Changes

4/23/24 - Nursing Home Changes

4/19/24 - UPDATE: Christian Music Artist Mandisa Has Passed Away - Tributes

4/19/24 - UPDATE: Christian Music Artist Mandisa Has Passed Away - Tributes

4/19/24 - Israel Carries Out Military Strike Against Iran

4/19/24 - Israel Carries Out Military Strike Against Iran

4/18/24 - Ford Issues Another Recall For Some Broncos

4/18/24 - Ford Issues Another Recall For Some Broncos

4/17/24 - Increased Thefts At Construction Sites

4/17/24 - Increased Thefts At Construction Sites

4/16/26 - Conference Focuses On Michigan's Tourism Industry

4/16/26 - Conference Focuses On Michigan's Tourism Industry

4/15/24 - TAX Day - File By Midnight

4/15/24 - TAX Day - File By Midnight

4/11/24 - Ford Airport Continues To Upgrade & Expand

4/11/24 - Ford Airport Continues To Upgrade & Expand